Principal 401k calculator

Penelope makes it simple. To give you an idea 20000 in a 401 k 403 b or 457 b account could triple in 20 years at an average 7 rate of returnbut not if you withdraw it today.

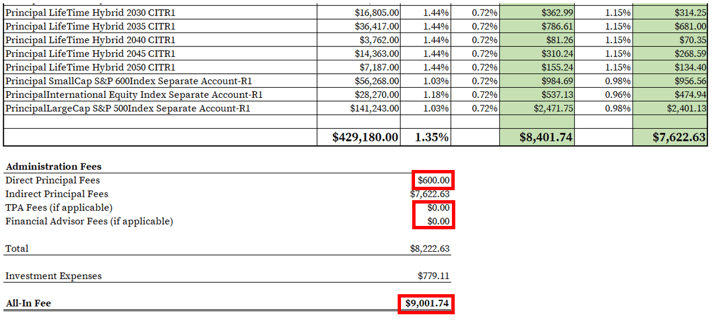

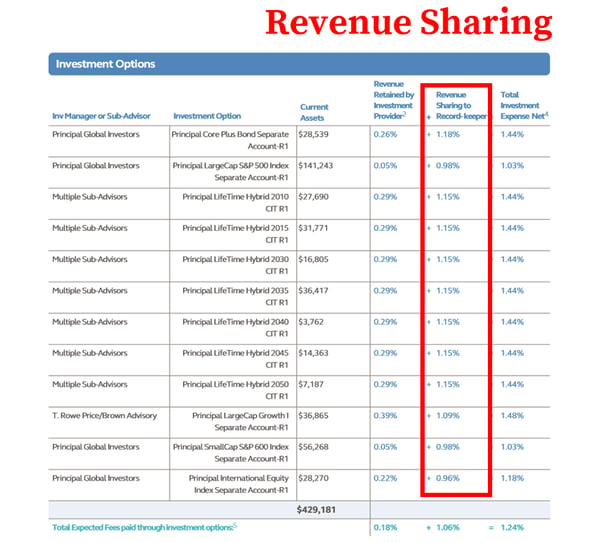

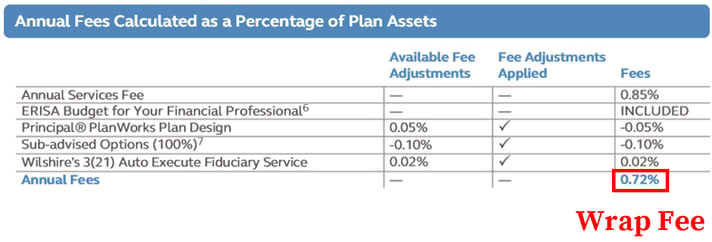

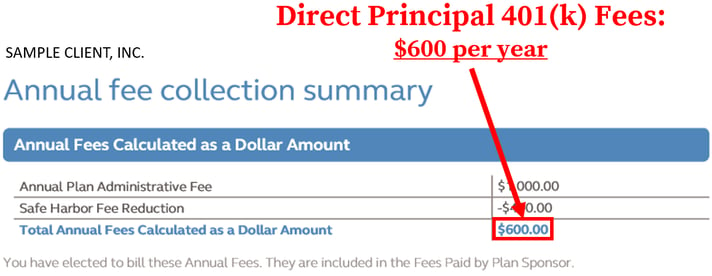

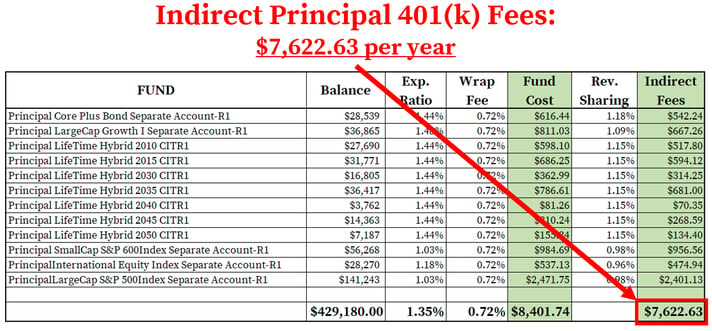

How To Find Calculate Principal 401 K Fees

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

. 401k Calculator 401 k Calculator A 401 k is an employer-sponsored retirement plan that lets you defer taxes until youre retired. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment return. 401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement.

In addition many employers will match a portion of your. Next we need to add your direct. If you dont have data ready.

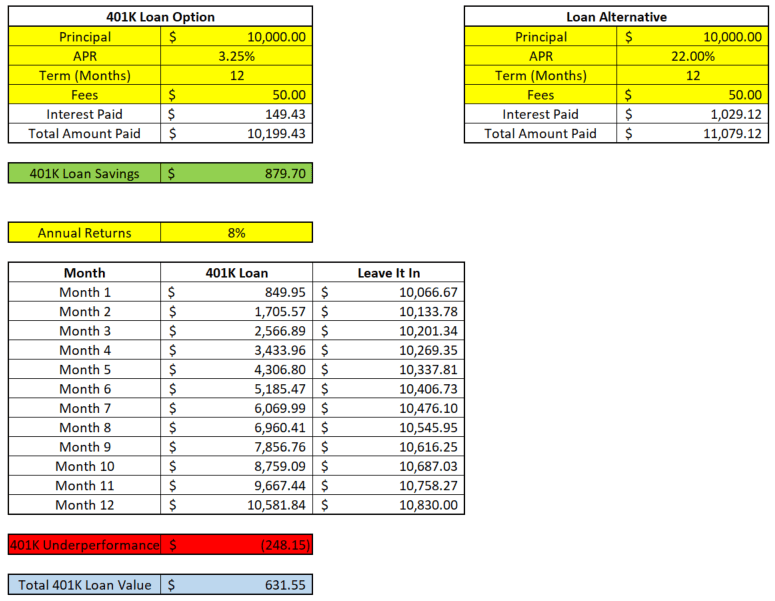

This 401k loan calculator works with the user entering their specific information related to their 401k Loan. Percentage of Pre-Retirement Income to Replace in Retirement of 80. Small business 401k plans with big benefits.

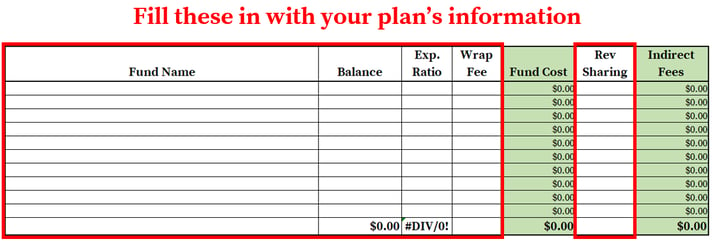

Titans 401 k calculator gives anyone the ability to project potential returns from a 401 k retirement fund based on your current age 401 k balance and annual salary. Ad A Rule of Thumb Is That Youll Need 10 Times Your Income at Retirement. First enter the fund information from your Principal 408 b 2 document into the spreadsheet.

The formulas will automatically calculate your indirect fees. Our 401 k Growth Calculator is a simple and easy way to estimate the long-term growth of your 401 k retirement account by the time you want to retire. 401 k Early Withdrawal Costs Calculator Early 401 k withdrawals will resu See more.

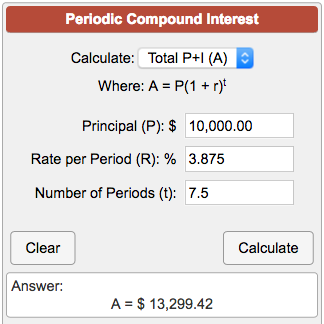

The interest rates on most 401 k loans is prime rate plus 1. It simulates that if you contribute. It provides you with two important advantages.

It is mainly intended for use by US. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment. Make a Thoughtful Decision For Your Retirement.

The Retirement Wellness Planner information and Retirement Wellness Score are limited only to the inputs and other financial assumptions and is not intended to be a financial plan or. Studies suggest replacing at least 70-85 of your income in retirement. Ad Open an IRA Explore Roth vs.

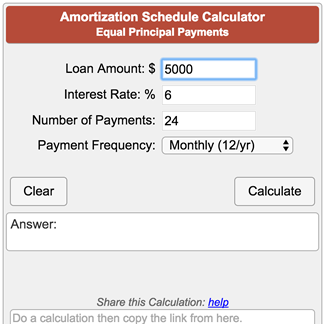

Instructions for using the Solo 401k Loan Calculator. This calculator assumes that your return is compounded annually and your deposits are made monthly. This 401k contribution calculator helps streamline the process of figuring out how much you should contribute toward your 401k to meet your future goal.

Terms enter number of years no more than 5 Interest Rate enter loan interest rate. To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation. Principal enter the loan amount.

Thats why one common strategy is to use a deferred comp plan as a bridge in retirement income. The score compares what you are estimated to have in monthly income at retirement against your estimated. Quickly see whether youre on track with your retirement goals and see which small changes could add up to a potentially big impact.

1 IRS annual limits for 2022. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. The annual rate of return for your 401 k account.

Traditional or Rollover Your 401k Today. A Retirement Calculator To Help You Plan For The Future. Loan terms and rates are determined by your plan administrator your employer in other words.

Affordable easy payroll integrated. Nonqualified Deferred Compensation Planner. The actual rate of return is largely.

Ad Attract and keep employees with 401k plans. If your employer offers a 401k 403b or other defined contribution plan with Principal. Log in to see your.

The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. Ad See how Invesco QQQ ETF can fit into your portfolio. It can fill the gap between income earned.

Begin by entering your 401k loan amount the interest rate and the period of time it.

30 Free Online Financial Calculators You Need To Know About Expensivity

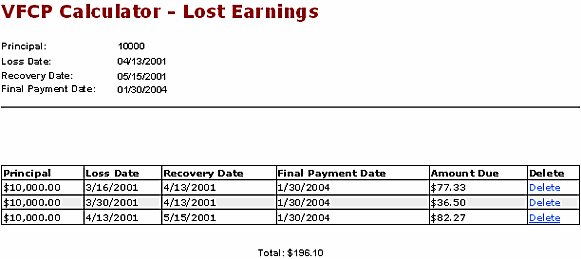

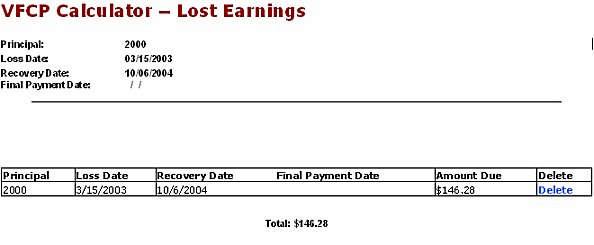

Voluntary Fiduciary Correction Program Vfcp Online Calculator With Instructions Examples And Manual Calculations U S Department Of Labor

Use This Free 401k Loan Calculator To See If A 401k Loan Is Right For You

Voluntary Fiduciary Correction Program Vfcp Online Calculator With Instructions Examples And Manual Calculations U S Department Of Labor

Principal Amount Formula How To Calculate Principal Video Lesson Transcript Study Com

How To Find Calculate Principal 401 K Fees

How To Find Calculate Principal 401 K Fees

Amortization Schedule Calculator Equal Principal Payments

How To Find Calculate Principal 401 K Fees

How To Find Calculate Principal 401 K Fees

How To Use The Excel Cumprinc Function Exceljet

How To Find Calculate Principal 401 K Fees

Catch Up Contributions How Do They Work Principal

Periodic Compound Interest Calculator

Extra Principal Payment Calculation Financial Calculator

How To Find Calculate Principal 401 K Fees

Fixed Principal Loan Payment Calculator